The JanSamarth Portal helps you access government loans. It connects borrowers with lenders for financial support in education. Also in business, agriculture, and livelihood. Whether you need help paying for school or want to start a business. The JanSamarth website is here to help you reach your goals.

With the increasing demand for quick and easy access to loans. The portal simplifies the application process. It eliminates the need for many paperwork submissions and long approval waiting periods. The digitalisation allows you to get prompt assistance to meet your requirements. In this article, we will explain what JanSamarth is. And walk you through its advantages, loan types, and how to apply.

What is the JanSamarth Portal?

The JanSamarth Portal connects borrowers with lenders for loans. It helps with education, business, agriculture, and livelihood. Need money for school or to start a business? JanSamarth can help.

The portal makes loan access fast and easy. It reduces paperwork and shortens approval times. The digital process ensures quick support. This article explains JanSamarth, its benefits, loan categories, and how to apply.

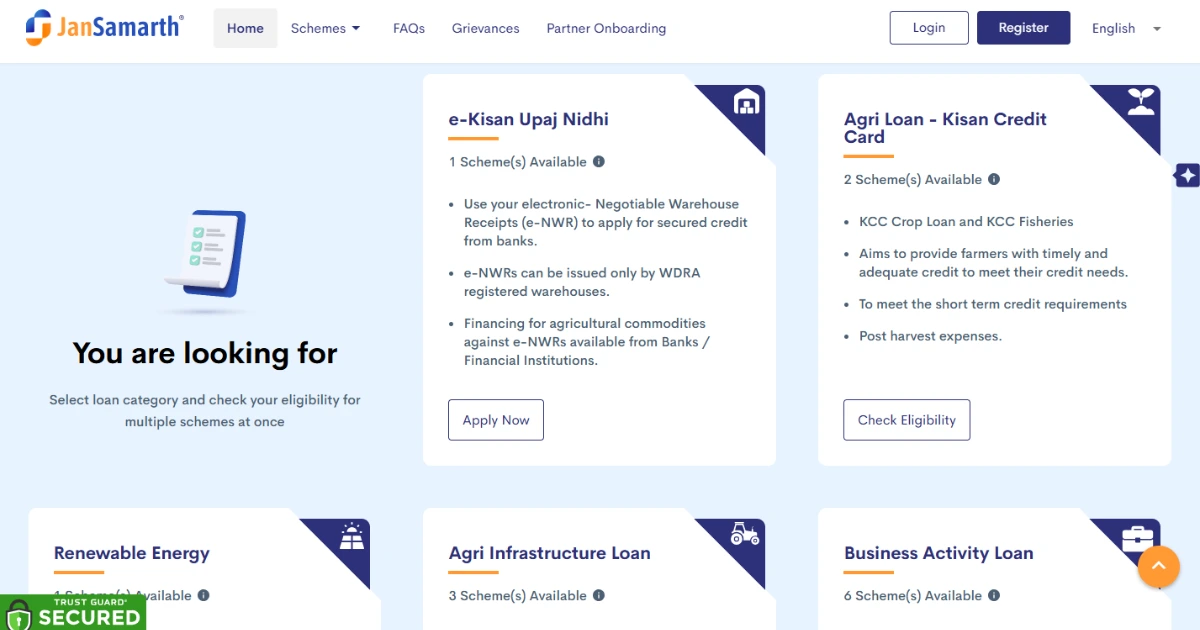

Loan Categories Available on the JanSamarth Portal

Four loan categories are available through the JanSamarth Portal: livelihood, business, education, and agriculture. Students, business owners, and farmers in need of assistance fall under these categories.

1. Education Loans

Education is one of the primary sectors where financial support is crucial. The JanSamarth website offers education loans through government schemes. These loans support students from low-income families. For helping them pursue higher education in India and abroad.

- Central Scheme for Interest Subsidy (CSIS): Offers interest subsidy to students studying for higher education in India.

- Dr. Ambedkar Central Sector Scheme: Offers interest subsidies for students pursuing education abroad.

2. Business Loans

JanSamarth helps entrepreneurs and business owners get financial aid. It offers loans with low-interest rates and flexible terms. You can apply if you are starting a new business or growing an existing one.

- PMEGP: Credit-linked subsidy for self-employment ventures.

- PMMY: Microcredit for businesses that require funding for small enterprises.

- Stand-Up India Scheme: Loans specifically for women and scheduled caste or scheduled tribe entrepreneurs.

3. Livelihood Loans

Jan Samarth Portal offers schemes to help people. And self-help groups start businesses and earn more.

- DAY-NRLM: Helps the urban poor set up self-employment ventures.

- SRMS: Provides loans and skill training to rehabilitate manual scavengers and other marginalized groups.

4. Agriculture Loans

Agricultural loans on the JanSamarth website support farmers. The outcomes have been employed to promote yield, to make farm structures, to adopt new agricultural technologies. These facilities (purchase-need loans, and upgrading post-harvest technology loans).

- ACABC: Provides financial aid to agricultural graduates who wish to set up agri-businesses.

- AIF: Supports rural markets and agricultural infrastructure development.

How to Apply for a Loan through the JanSamarth Portal?

Applying for a loan through the JanSamarth Portal is a simple, step-by-step process. Here’s a guide to help you get started:

Step 1: Check Eligibility

Go to the JanSamarth website. Check if you qualify for the loan schemes. Next the portal will ask for data and the available schemes will be presented.

Step 2: Fill Out the Application

Once you’ve selected the loan scheme that fits your needs, the next step is to fill out an online application. Provide personal and financial details. Upload documents like your Aadhaar card, PAN card, and bank statements.

Step 3: Submit and Receive Approval

After you submit your application, the portal will process it. You will receive a digital loan approval in principle. Then, a lending partner, like a bank, will contact you to complete the formalities and disburse the loan.

Benefits of the JanSamarth Portal

The JanSamarth provides several key benefits that enable a simple and fast loan process for any type of applicant. Here’s why you should consider using the portal:

- Centralized platform: All loan products are available in a single point of access enabling straight comparison and selection of the loan product that gives the best response to your need.

- Simple application process: It is not necessary to go to some of the offices or complete some of the detailed forms. Everything is handled online, ensuring a hassle-free experience.

- Faster loan approval: Faster response and quicker disbursement of loans are now with you as the digital application and approval are in place.

- Government-backed security: All types of loan provided are supported by the Indian government who guarantees security and credibility.

Conclusion

The JanSamarth Portal is an essential tool for anyone seeking a government-backed loan. The portal helps you get financial support for education, business, agriculture, or livelihood. It simplifies the application process and connects you directly with lenders. With various schemes, the portal serves people in all sectors. Making sure financial help is available to those in need.

If you want an easy way to access government loans, visit the portal today. Its simple interface and wide range of loan options can help you reach your personal or professional goals.

FAQs

Q1. How do I apply for a loan on the JanSamarth Portal?

Ans. To apply for a loan, visit the JanSamarth Portal, check your eligibility, and complete the online application. You will need to upload required documents and submit your application for approval.

Q2. What documents do I need to apply for a loan?

Ans. Commonly required documents include Aadhaar card, PAN card, proof of income, and bank statements. Specific documentation may vary depending on the loan scheme.

By using the JanSamarth website, you gain access to essential financial support that can make a big difference in your life, business, or farming practices. Don’t miss out on the opportunity to apply for a loan today.

Read Our More Blogs..